Immigration Rules and Business VISA Training

When you become a client of NCP’s, you will receive full access to our Immigration resource to help you with work VISAs when required and your best options. If you have specific questions on your situation, you will be provided with a recommended immigration attorney’s contact information.

What is the Best Legal Structure?

Your options are either an LLC taxed as a partnership, and an LLC disregarded for tax purposes, an LLC taxed as a C corporation or a C corporation.

The ownership of your U.S. entity will come into play regarding ownership and other U.S. tax returns that may be required if you are deemed to be engaged in a U.S. trade or business.

An S corporation is not an option for a foreign owner because you would not meet the S corporation shareholder rules.

- Annual gross revenue

- Annual net profits. This is an important part of your U.S. company formation.

- The goal of net profits to reinvest or distribute

- Number of partners

- Ownership structure

- Sales tax compliance when selling products. Even if no physical nexus in the U.S.

- Safe vs. risk assets (should be in separate entities)

- If real estate, what states will the entity own the real estate

- Partner’s ownership (individual, foreign trust, foreign corporation other)

- Type of income

- U.S. 30% withholding rates

- Effectively Connective Income

- Permanent Establishment

- U.S. tax treaty with your country

*When you incorporate with NCP, these questions will be addressed in our 45-minute video overview to which state and entity are best. Separately, we have paid strategy sessions available. When you become a client, we have 20 partners specializing in other areas for support, including legal, tax, trademarks, and immigration resources.

U.S. Banking Options

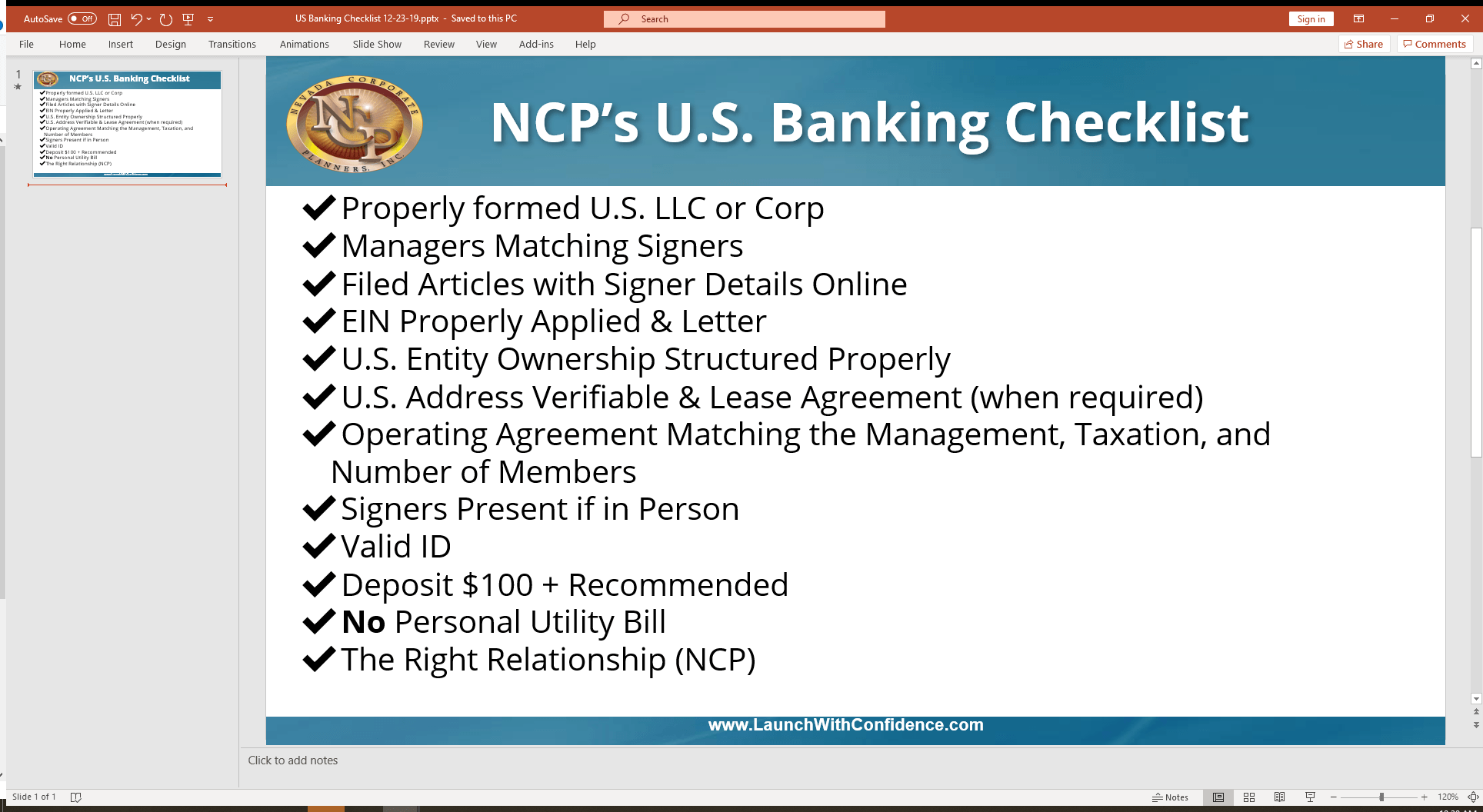

Rules have changed a lot over the last couple of years with your ability to establish a U.S. bank account without having to travel to the U.S. If you are planning to go to the U.S., there are many options for you, and you will want to make sure the bank account is established in the proper jurisdiction.

Please email us at support@launchwithconfidence.com for our most current banking solutions and what is possible.

If you are not planning to travel to the U.S., your options are limited, but there are payment gateways to help get your money back to your country (many times saving you money over wiring via a U.S. bank). NCP does have an option for your U.S. business to establish a U.S. bank account when you travel to the U.S.

We now have an opportunity to establish a full U.S. bank account WITHOUT travel. This is available with our U.S. complete packages. Learn more at this link.

Please keep in mind banks are subject to change their policies at any time. Some banks require a U.S. utility bill. We have solutions with our bank providers to help get your account open when you travel in person.

U.S. Virtual Address & Mail Services

Establish a U.S. Virtual Premium Address, Scan Sales Tax Permits, Merchant Statements & Other Virtual Business Mail for Timely Execution. Receiving your Sales Tax Registrations, Late & Demand Notices, or Merchant Chargebacks late, or not at all, leads to massive unnecessary costs to your business. Let’s solve this for you.

The big difference with our virtual mail service is our team will know what each notice (IRS, state sales tax notice, Bank update…), and either we can direct you how to get it handled or refer you to a partner that can provide support.

Only need a U.S. address for mail purposes and looking to avoid a permanent establishment? Are you an e-commerce seller with economic nexus in multiple U.S. states? Not just selling on a marketplace facilitator platform such as Amazon, eBay, or Walmart, where they are collecting?

You may have multiple states where sales tax registration is still required, and that will lead to lots of mail for you to manage. The best part is that our team will handle the mail for you with our virtual mail service.

U.S. EIN

An EIN (employer identification number) is required for each new entity (corporation or LLC) in the U.S. NCP will send you the form SS-4 completed via email for your signature to scan and email back to our offices. We will obtain the EIN through the IRS within 5-6 business days of our SS4 application being completed and received by our office. This requires us to fax the application to the IRS with our address and as the third party designee and follow up with a call to the IRS after the 5th day. It is a different process as a foreign individual or foreign entity that involves calling the IRS.

U.S. Taxes

Forming a U.S. entity will trigger U.S. tax returns required for your business. This may include both a federal return, such as 1065 for an LLC taxed as a partnership, and a 1040NR on the partners (if individuals) or 1120F or 1065 if a foreign corporation or partnership is the owner of the U.S. entity (along with IRS forms 5472 and 8833). A single-member LLC disregarded will trigger form 5472 and 1120. This doesn’t mean the LLC is paying tax like a Corporation, but rather, it’s simply reporting information like a Corporation.

There are several other reporting and U.S. tax filings requirements*. As a client of NCPs, you will receive timely emails throughout the year to remind you of the U.S. tax requirements and a referral to the U.S. CPA firm we work with to ensure you are compliant with U.S. taxes and your countries tax treaty.

* U.S. Federal Taxes Due when a Foreign Entity or Individual owns a U.S. Entity

There are two categories the U.S. entity and situation may fall into:

1. ECI (Effectively Connected Income) is defined as income from sources within the U.S. connected with a foreign person’s conduct of a trade or business in the U.S. ECI is taxed on a net basis after deductions for allocable expenses at regular U.S. income tax rates, OR

2. FDAP: fixed or determinable annual or periodic income is subject to withholding at a 30% flat rate. This is a FLAT TAX on GROSS INCOME (with NO deductions that come into play). This is designed for a U.S. entity that is involved in a “holding” or “passive” type activity in the U.S.

A regular C corporation would have its federal tax rates. A single-member LLC disregarded for tax purposes or a sole proprietorship would be required to file estimated quarterly taxes, but there is no withholding. Working with tax professionals in the U.S. is highly recommended who has experience with non-U.S. clients.

Sales Tax for e-commerce sellers: Since the 2018 Wayfair vs. South Dakota U.S. Supreme Court Case, e-commerce sellers need to track both physical and economic nexus to know when to collect and remit sales tax. NCP sister brand, Sales Tax System, has filed thousands of sales tax registrations for e-commerce sellers since 2015.

U.S. Entity Formation Key Points

We’ve talked to hundreds of international business owners over the past 23 years. If there’s one thing I’ve learned, beyond the shadow of a doubt, from those who have needlessly poured money down bottomless tax or expense holes after being sued and from those whose businesses have failed, it’s this:

NOT ONE was excited over the few bucks they saved using a low-cost incorporator — or worse, flying solo — to incorporate or establish a U.S. Entity for their business.

Years and untold dollars later, they sorely regret the hard work, stress, and many, many lost hours with family and friends — consumed instead dealing with lawyers, bankers, accountants, and creditors, while picking up the pieces of the wreckage from a devastating lawsuit or bankruptcy.

All those losses could have been prevented by proper planning with the right company to support them. All those losses were the indirect and sometimes direct result of “penny-wise, pound foolish” thinking. They’ve learned (the hard way) the value of having a company like NCP to be at their side, continually guarding against missteps and roadblocks.

I hear the same basic horror stories told over and over again. And while I’d never say, “I told you so,” I’ve learned from them as well.

When investing in any services, you want to get what you pay for, maximize your investment, not get more than you need, and not find out after it is too late that you purchased a “tripwire” get-you-in-the-door package that was low-priced and causes you a lot of serious issues months or years from now. Those issues may include your bank account being closed in the middle of your next big promotion to U.S. federal or state tax notices or, even worse, a lawsuit, and come to find out you had ZERO protection.

You (rightfully so) may have thought or read that a U.S. LLC is a U.S. LLC (or corporation); “How complex could this be? Therefore, let me find the lowest-cost service for what I need to process merchant payments, provide a legal entity separate from my home country, open a U.S. bank account…

This is all a reasonable process, and no one laid out the connecting points until now.

Below is a 2-minute preview of our 45-minute video helping you determine which state and entity are best. You will gain full access to the training when you sign up with one of our packages below:

There is much more to forming a U.S. entity than just filing articles with a company online, grabbing a U.S. address service, and getting an EIN for $300 (a typical “tripwire” price to get you in the door. Most of the time, this leads to unforeseen problems from 3 months to 2-3 years down the road.

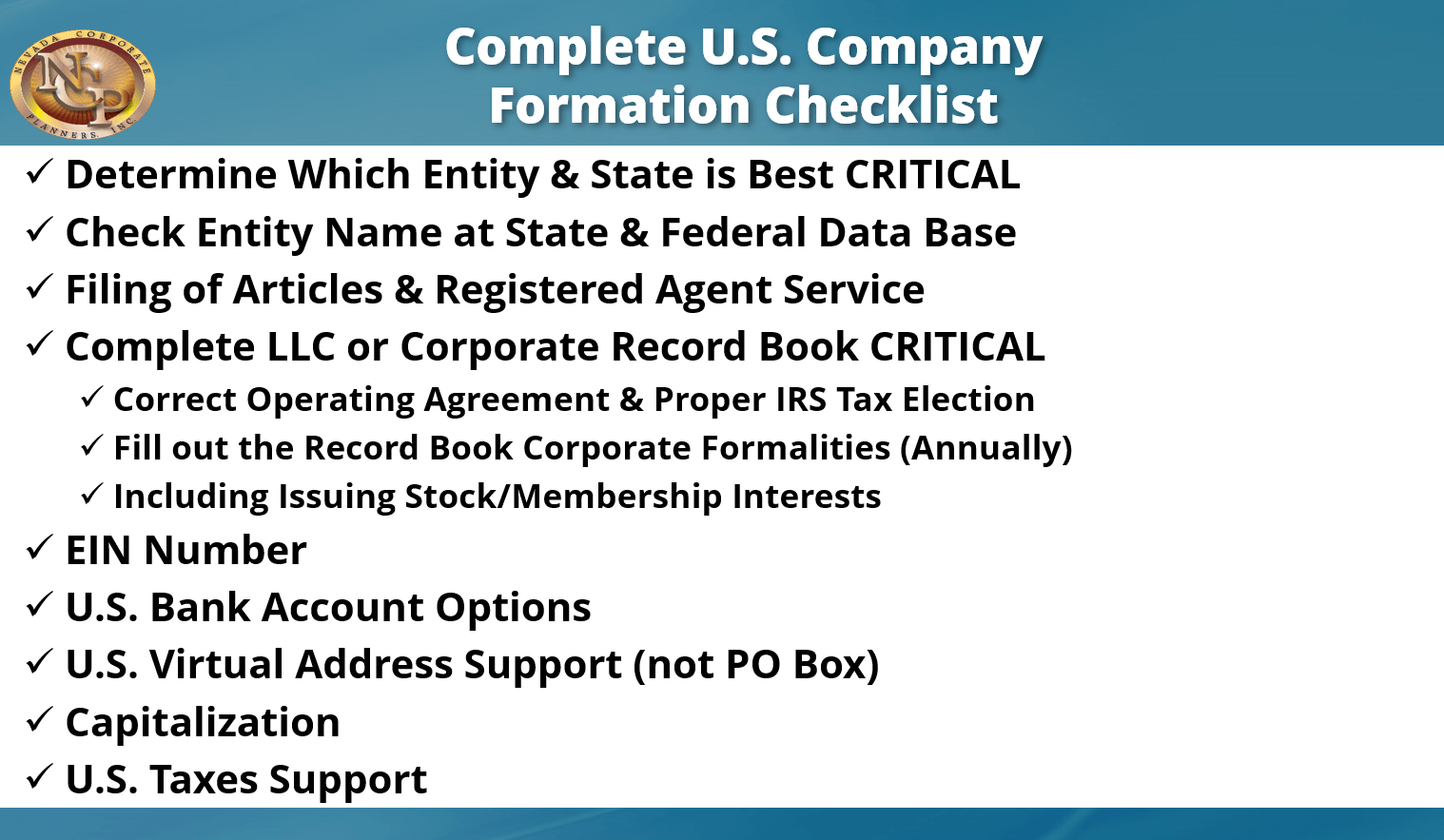

What is different with NCP is we ONLY do a COMPLETE U.S. FORMATION, and either has the training, checklists, or resources that covers

Doing business in the U.S. is one of the best opportunities to grow, especially if you are operating online. The U.S. has the largest online consumer market in the world! The key is to develop trust with a legitimate U.S. company

Are you an E-Commerce Seller Looking to Expand to the U.S.?

As a foreign e-commerce seller, there are many factors to consider when expanding to sell on Amazon.com, eBay, Etsy, and even if you are fortunate to sell on Walmart. Below is our list of areas to consider including;

Why expanding to the U.S. is complex

- Multiple Variables

- Different Business Set-Up

- U.S. person vs. foreign person

- Amazon FBA vs. FBM –>Inventory in the U.S. Warehouse

- Partner vs. No Partner

- tax treaty vs. no tax treaty (hong kong)

- Entity types

- Shopify vs. Amazon, Walamrt, eBay

U.S. LLC advantages/disadvantages

Advantages:

- Separate liability from your foreign e-commerce business

- Protect your foreign account, assets, and income stream

- Easier to sell business assets

- Easier to obtain business liability insurance

Disadvantages:

- Slightly more investment

- Operating two legal companies

Marketplace issues

- Account Not Activated/Approved

- Errors with items matching up

Address on business must match your bank statement

Credit card number must be valid

Phone number during registration

TOS violation one category

- Errors with items matching up

The address on the utility bill is written in Russian with different letters of

the alphabet than what you entered on your Amazon account.

Banking, EIN, Business Structure

Our Complete U.S. LLC/Corporation Formation Packages:

Once you get started, you will have immediate access to our video training on which state and entity are best for you. You will also have access to our video with our U.S. tax attorney on U.S. tax responsibilities.

To get started now with a Complete U.S. Formation.

See Our Packages

Here is a review of the process to establish a complete U.S. company:

- Select a Package

- Payment

- Thank you, page and welcome email has a link with video training and our form to complete your entity information.

- Send you an email to pay the state fees (if not already paid upfront)

- We send you an email to verify your information.

- Entity filed within 3-7 business days, record book in another 5-10 business days, EIN 45 business days during COVID, bank account details are sent to you to let us know when you would like to travel to the U.S. to establish your account.

- Support

- NCP members with online videos on record book and training

- World-class customer service support with our ticket system

- Videos on every form to make it simple

- Launch with Confidence checklists

- Referral partners for legal, tax, immigration, sales tax, and other areas of support.

U.S. Customer Service Support

As a client of NCP’s, you will have full access to our support team. Plus, you will have access to our NCP members area filled with recorded training to help you with your common questions, including U.S. taxes, payroll, immigration, and others. You will receive a launch with a confidence checklist to keep you on track, and our team will walk you through the entire record book to complete the necessary forms and documents.

You will also have access to online training videos to guide you through the entire record book online. NCP offers other strategy sessions, sales tax compliance, and tax resources to help you Launch Your U.S. Business with Confidence!

Watch one of many testimonials from our happy client below. Watch more client testimonials and experiences at this link.

Three Costly Mistakes to Avoid When Establishing Your U.S. Company

1. Costly Tax Mistakes with the U.S. Internal Revenue Service (IRS).

There are many pitfalls and hidden land mines that can cause you a lot of damage with your U.S. company if you do not have all the facts upfront. You must know which entity is best and the U.S. tax ramifications if it is taxed as a C corporation vs. an LLC. Both have very different U.S. tax structures. You may need an ITIN number, and you will need an EIN. You must file the proper tax returns the following year. Setting up your company in the wrong state may cause you to pay an extra 5-8% of unnecessary state taxes. An LLC can be taxed in different methods; one will could result in a flat 30% withholding tax on all profits before they flow back to you in your home country. If you plan to expense out profits to your home country, you must be familiar with IRS form 5472 with the IRS (missing this form may create a $10K penalty for you)! Having the IRS auditing your U.S. company can be a fast way to go out of business with penalties and interest!

2. Blowing Your Chance at Setting up a U.S. Bank Account.

It is required to travel to the U.S. to open a U.S. bank account (assuming someone else in the U.S. is not signing on your account for you). Most assume since they are traveling and here in person, it will be easy to establish a U.S. bank account for a newly formed LLC or Corporation, that is not the case. Most bankers will look at your new entity as a new local business and expect to see a local utility bill or office lease agreement. They may also require an ITIN or SSN on the signer and all signers present. Establishing a “cheap” online LLC and looking for bank account support, and having to amend the LLC, add other parts to complete the entire package for the bank, is typically more expensive than doing it right in the first place with NCP.

3. Inconsistency in Your U.S. Company Set-Up

This happens when someone will set up a corporation in one state, a bank account in another state, and a mail forwarding program only with a virtual U.S. phone number. You may get your bank account set up, but this will backfire when developing trust in the U.S. market. Only having a U.S. P.O. Box as your U.S. address sends a strong message to the U.S. consumer that you are a flake or attempting to hide something. Trust is the name of the game. Don’t get cheap to save a few dollars and lose out on sales and joint ventures because of it.

CAUTION: Many online companies may make this appear to be simple—meaning, very few steps for a low price. You do not want surprises, especially when you are not based in the United States. NCP’s goal is to remove surprises and provide the support you need with a complete process.