The best strategy is to incorporate in 2023 vs. 2024 for many important reasons. If you’re operating your business as a sole proprietorship, this is a logical time of the year to think about forming an entity going into January 2024. Doing this will make your business official, cut your TAX bill, and lower your risk of an IRS AUDIT. Now is the time if you are outside the U.S. and looking to launch your U.S. e-commerce business.

Now, there is a new element of compliance in 2024, the Corporate Transparency Act, which may seem simple on the surface to submit your beneficial owner’s information to FinCEN, but keep in mind, for any changes to the beneficial owner’s information, you must update your report within 30 days, or face a possible $500 per day fine. NCP has the best resource to help you comply with the Corporate Transparency Act.

That’s a SMART MOVE, except for one part – waiting until January.

As you may have heard, incorporating in January gives you a clean cutoff for the year, eliminates the complication of a “short year” tax return, and helps you smoothly transition from a sole proprietorship into a separate legal entity.

Even with all those very real advantages, waiting until January is NOT the best approach.

January is the busiest time of the year for filings and, therefore, the slowest. If you form your new entity at the beginning of January, the entire process could take weeks for you to complete the paperwork, get your EIN, and open a bank account. For U.S. residents, you’ll be stuck filing another Schedule C for the income you receive early in the month, which will likely go to you personally or the DBA (doing business as) name you’ve been using for your sole proprietorship.

Schedule C is the most highly audited IRS form, which puts you back in the IRS audit trap for a whole new tax year.

How can you escape the sole proprietorship, liability, and audit trap without filing a SHORT-YEAR TAX RETURN?

The answer is to have us form the entity for you NOW and set the IRS start date for January 2024. The January start date allows time for your filing and EIN to be processed in December. This puts you in a position to AVOID A SCHEDULE C for your business in 2024. The strategy to incorporate in 2023 is a double win because it eliminates an additional short-year tax return for your new entity in 2023 (now through December 31st).

On top of all these practical reasons, it’s important to know that operating as a sole proprietorship is NOT the fast track to success; it’s the shortest path to joining the 95% of businesses that fail in the first five years.

You probably chose a sole proprietorship for one of three logical reasons: (1) you were looking for the easiest and cheapest way to get started, (2) you wanted to test the waters to see if your idea would make money, or (3) your tax advisor told you to keep it simple and go the sole proprietorship route until you earn more than $40K to $50K in profits.

Unfortunately, even though I don’t believe this is what you’re thinking, here’s the implied message the rest of the business world ASSUMES you have in mind when they see you operating as a sole proprietorship:

“I don’t believe in myself, my product, or my service, or I don’t expect

to make $40K in profits.”

Since 1997, we’ve helped over 6,500 entrepreneurs reverse that message, escape the sole proprietorship trap, and make a fast start to profits. Here are just a few of the strategic insights that woke my clients up to the money they were leaving on the table:

1. Sole proprietors file a schedule C with the 1040 form in April. Schedule C filers are 300% more likely to be audited (the IRS is leaning on small business owners to close a $300-BILLION tax gap!). If your business lost money in 2023, you’re especially at risk if you plan to write those losses off against other income.

2. Sole proprietors pay the most in taxes. You will pay 15.3% on the first $160,200 in 2023 of net income and $168,600 in 2024.

3. Operating as a sole proprietorship and self-financing your business damage your personal credit score. Sole proprietors frequently turn to self-funding through personal credit cards or cash reserves because their business credit options are limited. The resulting damage to your personal credit score will severely limit your ability to build business credit when you finally get around to forming a separate legal entity.

4. A sole proprietorship sends a negative marketing message. Before working with you, the biggest potential customers, suppliers, and marketing partners look at your company’s structure. This way, it broadcasts the message that you don’t expect enough profits to incorporate. Why expose yourself to that kind of opportunity cost, especially at a time when you can least afford it?

5. You have unlimited personal liability. A sole proprietorship does not provide you or your family with minimal protection in the all-too-frequent event of a lawsuit or other challenges to the assets you’re working so hard to build.

6. There is no reason to build business credit on a sole proprietorship with the business credit bureaus. The goal is to form a separate legal entity and build your financial credibility with the business credit bureaus and on your new EIN. Protect your personal credit score by obtaining a business credit card under the entity and EIN, not your SSN. Putting your business in the best possible position to maximize funding can be the difference between being in or out of business within 12 months.

You have unlimited personal liability. A sole proprietorship does not provide you or your family with minimal protection in the all-too-frequent event of a lawsuit or other challenges to the assets you’re working so hard to build.

ESCAPE THE SOLE PROPRIETORSHIP TRAP WITH CONFIDENCE.

If you are outside the U.S. and looking to expand your e-commerce business to multiple U.S. platforms (Amazon, eBay, Walmart…), you will, in some situations, want a U.S. LLC taxed as a U.S. taxpayer/person, resulting in a W-9 being filed. The key is working with a company like NCP that has expertise in working with the Amazon and Walmart platforms. The time frame for EIN (15 business days), the strategy’s execution, tax treaty details, sales tax compliance, and more? The good news is that NCP can help you confidently launch your U.S. company.

There’s a way out of ALL these real-world risks (and others we don’t even have time to discuss here). NCP has hassle-free solutions to handle them quickly and affordably – so you can start 2024 confidently.

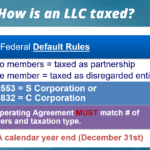

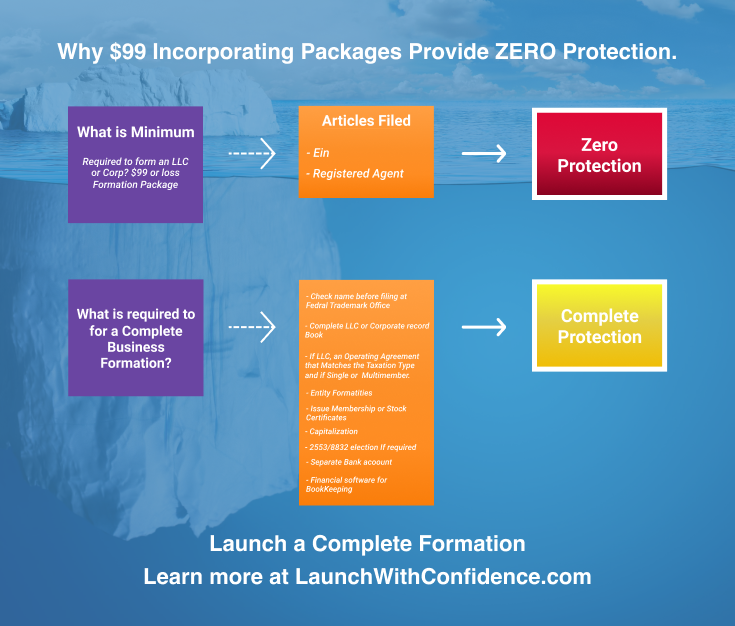

When you form a new entity before 2023, the key is to form a COMPLETE form for your business so you have real protection. If you file articles or get one of those $ 99 tripwire offers to get you in the door, there is ZERO protection with that approach. If you are outside the U.S. and looking to do business in the U.S., see the details below for your best options.

If you are a U.S. resident, visit this page to learn about our LLC and corporate formations. If you are outside the U.S., consider the extra time frame to apply for an EIN and establish a U.S. bank account. Visit this page to learn more. During the filing process, you will let our team know if you want a start date on the SS4 of 2023 or 2024.