As you grow your product or services with your business, you will come to the point that you may consider forming a new entity or instead just filing a DBA linked to your operating entity. It is one thing to grow a business and your net worth, and it is another to keep it. The key to your financial success over time is to diversify your risk.

Unfortunately, this is a common theme for your investments, but not when it comes to businesses. We all know not to have 100% of our investment money in one penny stock or one gold company. You may have 1/3 of your investments in an aggressive portfolio, 1/3 in a moderately aggressive and 1/3 in a portfolio of safe returns. Your age and risk tolerance should also be considered. The older you are, perhaps the less risk you’ll probably want with your investments. When it comes to protecting and growing your BUSINESS ASSETS for whatever reason, most ignore a pattern that would make sense. What I find that most do is they have all their money invested in one high-risk investment, rolling the dice with their financial future.

What do I mean by this? I see entrepreneurs who have been in business for 7 or 8 years, still operating 100% of their business through ONE SEPARATE LEGAL ENTITY. That means one big lawsuit against the business (usually by a partner, investor, or customer) could be the end of your business. And if you are personally guaranteeing most of your debt, that means you will be on the hook personally and could potentially lose everything. You might kill the golden egg that provides you with annual income. Think about it. If you net $100K from your business, that is similar to a 5% return on a $2-million investment.

Here are some basic rules to follow to help you determine when to form a new entity or file a DBA to your existing entity:

1. Separate your safe from risky assets. Your safe assets include any assets that will not directly cause any liability, like gold, silver, a brokerage account outside your retirement plan with investments in non-exempt assets (like a mutual fund), an investment in a public company, or a private placement. If you put those in your living revocable trust (which means you can change it), they will NOT be protected from liability.

That’s right. You can get sued personally and lose all your assets from your living trust. I know you thought a living trust would protect your assets. The key question is, your living trust will protect your assets FROM WHAT? A living trust will protect your assets from probate and estate taxes, but NOT LIABILITY.

If your safe assets represent a significant value to your current or future net worth, a separate legal entity (unrelated to your business or an entity holding a risky asset like real estate) would be best.

Typically, this is an LLC taxed as a partnership or a disregarded entity. The worst approach is to “reactivate an older entity in a prior business” to hold your safe assets, to save a few dollars, instead of forming a new one. That may come back to haunt you from both a tax and liability viewpoint.

2. Separate your risky assets from other risky assets. This involves everything from one part of your business and another. Real estate should be owned by a separate entity from your operating business. If you have a successful business and you are going to add another venture (especially with a partner who is not related to the first business), then you must form a new entity for the new business with a partner.

Why have revenue going into an existing entity that you own 100% when you have a new partner involved. Let’s say that your current business is doing very well, and now you are adding a different component. Example: you sell an information product online, and now you want to start doing your events. Your events should be operating through a separate legal entity for liability purposes. The big question regarding real estate is how many properties per entity make sense?

That depends upon several factors, including the amount of equity in each property, the types of property, the risk, and the percentage of your net worth that represents. Does this mean if you have three rental properties, you need three separate LLC’s? No. It does mean you need at least one to own title. If all three have $500K of equity, and that is 90% of your net worth, then three LLC’s would make sense. Yes, real estate is transferred into an LLC has other issues to navigate, including transfer tax, due on sale, and insurance, and refinancing issues.

3. Other assets to separate. Your domain names, if they have value. Each domain name you reserve is virtual real estate that is free and clear. You may have a domain name that is worth $100K or more. The big mistake I see is having either you or your main operating company own your domain names. If you get sued, you can lose control of that asset and, if your company gets sued, you could lose control. It may make sense to have a separate LLC to own all your domain names and lease them back to your operating companies.

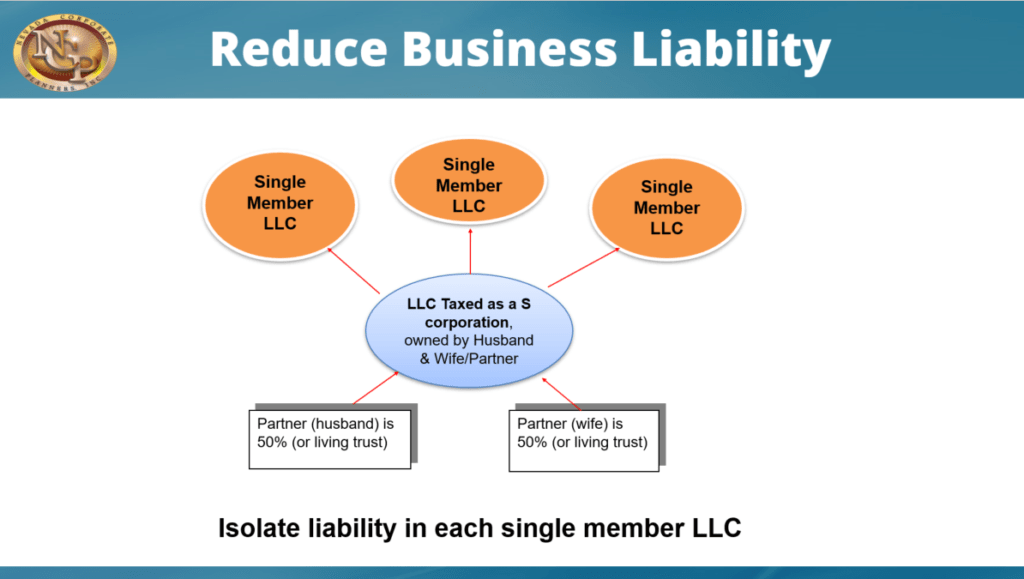

4. Ownership in C or S corporations. If you own stock in a C Corporation, you may want to consider protecting that ownership, especially if that is one of your main companies, and it has a lot of value. If you were to be sued personally, you could lose control of your operating company (assuming your insurance did not pick up the entire tab).

The solution is to consider an LLC taxed as a partnership to own the stock of your C Corporation. Now, if you get sued personally, the “charging order protection” makes it more difficult for someone to gain control of the membership interest in the LLC. They may only get access to the distribution of profits if any are made.

An S corporation with NO value in the stock is no need to worry. Suppose there’s no value. Who cares if you lose control of your company (same approach for the C Corporation). If the S Corporation has value, you have the same problem as the C Corporation if you are sued personally. Except, with the S Corporation, the only shareholder that will help can be a SINGLE MEMBER LLC taxed as a disregarded entity. An LLC taxed as a partnership can NOT be a shareholder in an S Corporation. There is an argument that some suggest that a one-member LLC charging order is a little weaker in some states than a two-member LLC. This is based upon a 2003 Colorado court case (similar case in Florida in 2010) where a bankruptcy judge ignored the charging order protection (because of only one member). Initially, the charging order protection came from partnership law, which, of course, meant two partners.

A final reminder. Forming a DBA and linking that to the current operating entity only creates a new name for the business; it does NOT form a separate layer for liability or taxes. It may make sense from a marketing perspective, but it may also create a separate legal entity. If you are starting and testing two or three sources of income, it will make more sense to use one entity and wait until two or more take off to consider separating them.

Should You File a DBA?

Here are more situations and recommendations to consider forming a new entity or just a DBA linked to your current entity. For example, our business name is Nevada Corporate Planners, Inc, and we have a DBA filed, “NCP,” our initials.

You are just starting your e-commerce business, already have a storefront business, and are involved in 2-3 different affiliate products.

Should all be operated through the same LLC (or corporation), or should you have one entity for storefront sales opportunities and affiliate opportunities? Most likely, if you are starting both endeavors simultaneously, it would be okay for both to be run through the same entity. Typically, an e-commerce business opportunity should not cause much product liability for your storefront business.

In this situation, filing a DBA with your existing entity as the applicant would make sense. Don’t make the mistake of filing the DBA linked to your name, creating a sole proprietorship, and no liability protection.

Check-in after six months; if both are incredibly profitable and successful, you may want to consider a separate entity. For most of you, one entity would be fine in this case. This does not necessitate any changes to the articles of an LLC.

Typically, if a corporation, the articles should engage in any legal business, which gives you the flexibility to operate more than one business. The exception will be if you own real estate outside of your residence. If you own a rental property, that will not go into the same entity as your direct sales opportunity.

The real estate will bring unnecessary risk to the e-commerce business, a low-overhead, and high-profit type business. Plus, if you buy real estate in the future, typically you want a flow-through entity for an e-commerce business, like an LLC, taxed as an S corporation, so you can pay taxes once and then close on a piece of real estate in your name personally, and then transfer it into a brand new LLC after the closing.

If you have a partner in your main business and you start the e-commerce with only one partner, in this case, you don’t want to file a DBA linked to your entity. It would be best if you had a separate entity for the business with your partner. You may consider an arrangement where you are not actually partners in an entity, but one of you is an affiliate or profit partner for the other. In the end, don’t “fake” running an entity with a partner, where there is some side commission deal that is not well written. Otherwise, this typically ends badly and in a lawsuit. Make a clear decision to become partners in an entity or not clarify the commissions or profits to be distributed.

Here is our summary of when to file a DBA to your existing entity and when to form a new entity:

Situations to file a DBA (DBA linked to a current entity) *

- Company domain name

- Company initials (Nevada Corporate Planners, Inc. has a DBA, NCP)

- Your business is not going to operate under the legal name. This is common with having a different domain name from the LLC or Corporate name.

- The new line of business that is not part of your current business name with similar risk

- Franchise owners file a DBA in the name of the franchise agreement.

- Affiliate or commission revenue

- New product brand (same owners, lower risk)

*A DBA name linked to an individual creates a sole proprietorship and provides zero protection. This is a common mistake when someone started a business as a sole proprietorship, later forms an LLC, and forgets to “refile” the DBA linked to the new LLC. A DBA name does not allow for an “LLC” or “Inc.” ending.

Situations to file a New Entity:

- Partner in new business

- New asset class (safe asset vs. risk asset)

- New service or product with higher risk

- Real estate outside of your personal residence

- Looking for investors

Do you see an area where you need support? If so, reach out to our team at support@launchwithconfidence.com.