You will need this Silicon Valley & First Republic Bank alternative as a non-resident business owner. We have important news if you’ve formed a Delaware corporation or U.S. company with Silicon Valley Bank as your only banking partner.

Due to recent regulatory actions by California authorities, Silicon Valley Bank has been closed. On March 10th, Silicon Valley Bank’s assets were seized by FDIC in the most significant bank failure since 2008. Just before noon on the East Coast, the Federal Deposit Insurance Corporation said it was closing the bank. On May 1st, JP Morgan Chase takes over First Republic Bank.

In business, the number one can be your worst enemy. Depending on a single joint venture partner, relying on a solitary source for leads, or working with only one supplier or vendor can leave you vulnerable to a single point of failure.

But perhaps the most crucial area where you should avoid being a “one” is banking. Having just ONE BANK ACCOUNT can be a recipe for disaster.

If that account is closed, frozen, or otherwise inaccessible, your business could be brought to its knees. That’s why it’s crucial to diversify your banking relationships and work with multiple partners. Doing so will ensure your funds are protected, and your business can continue operating even if one bank account is compromised. So, if you rely on just one bank account, it’s time to diversify. Don’t let the worst number in business bring you down – instead, take control of your financial future by working with multiple banking partners.

You must find an alternative U.S. bank account to continue operating your business. Fortunately, our team is here to help. We specialize in assisting non-resident business owners like you to set up an alternative banking solution quickly and efficiently.

If you still need a U.S. company formation, first gain clarity on your best U.S. banking options BEFORE forming a U.S. entity. You want to avoid what so many do: to find a low-priced option only to form the LLC and realize either during the process or after opening a U.S. bank account (even without travel) is impossible.

At NCP, our experience since 1997, with thousands of companies formed and working with dozens of banks, brokerage accounts, and online banking platforms.

We have the experience to help you fit all the puzzle pieces in the correct sequence to help you accomplish this task. As we can’t control the banks and their policy changes, we can control how best to form your U.S. company to lead to your best option to establish the bank account. This may involve how the LLC is formed and managed, to a lease agreement without an expensive lease, to match documents and state records to streamline the experience.

Most important is our relationships with our bankers and that we do things right and attract successful entrepreneurs that the banks prefer to work with over time. Let us share our current U.S. banking options and recommendations for 2023.

If you or someone you know needs support, we can help set up your U.S. entity correctly and have all the resources from sales tax to tax returns.

Here is our link to our U.S. LLC formation packages, with details and what’s included.

Before we get to the banking details, you must know this ONLY works on a U.S. entity, not a foreign entity.

As you know, we do a lot of work in the e-commerce space, and there are “banking” accounts, such as Payoneer and others.

The challenge is that moving money from one currency to another is great, but they must be fully functioning bank accounts. They do not allow for an ACH pull, which is required to automate the payment of sales taxes.

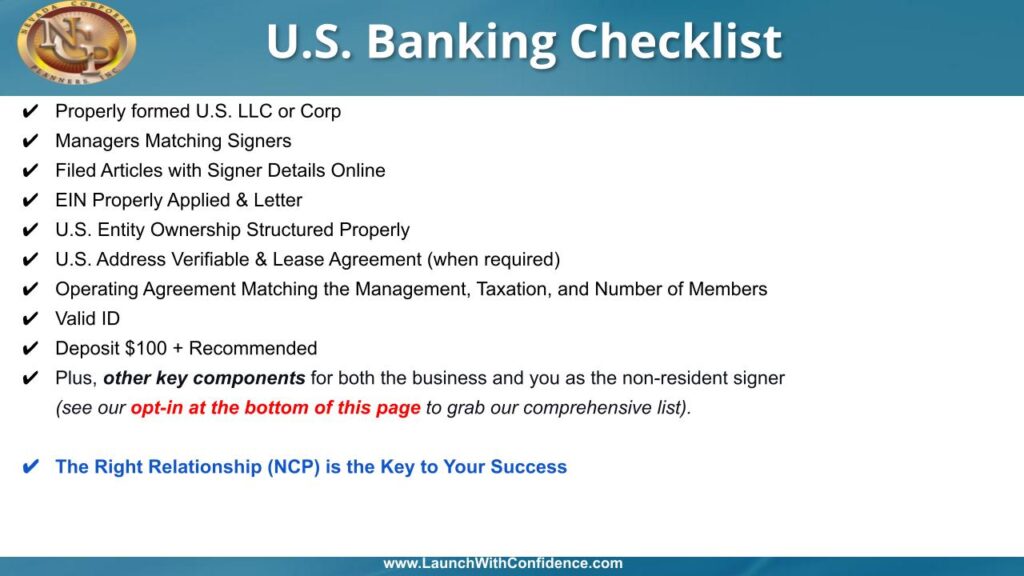

NCP’s U.S. Banking Checklist

NCP’s U.S. Banking Checklist

We have a relationship with a trustworthy company with a banking platform that works with a bank (not in California) that will work for non-U.S. residents, and you do NOT need to go to the bank in person.

Do you have these questions on your mind?

Is there a monthly bank fee?

We’ve been getting some questions about our banking partner and wanted to clarify some things. First, we want to assure you that our partner does not charge a fee for setting up your account. While we have a fee for the process and introduction, it’s not an extra fee you’ll be charged – it’s simply our fee for facilitating the process.

It’s also important to note that no requirements above and beyond the norm would make it impossible to open an account.

However, some U.S. banks have specific requirements that can cause issues for non-residents. For example, some banks may require a personal utility bill from a U.S. residential address, not a P.O. box, even if you visit the bank in person. Other banks may want to do an official site inspection and see your employees working.

But don’t worry – we’ve got you covered! We’ve compiled a complete checklist for our banking relationship that includes all the information you need to know to ensure a smooth account opening process. You can find it at the bottom of this page.

What is required to open this NEW U.S. Bank Account without Travel:

Required documents below per entity type:

LLC Documents

Corporation

Are you a company owner with a stake in a U.S. entity? If that entity is owned by a company with over 25% ownership, we’ll need the personal information and passports of the beneficial owners who have 25% or more ownership in that company. It’s essential to provide this information to ensure a smooth process.

Don’t stress; we’ve got you covered. We’ve created a comprehensive Silicon Valley Bank alternative checklist to answer all your questions and provide an alternative to Silicon Valley Bank. Our checklist ensures you cover all the bases and get the best service possible. So why wait? Get your hands on our checklist now at this link.