Sole proprietors are taking a significant risk in today’s business climate, much more than they have been told. It is time they know the facts and what they are up against to put the odds back in their favor.

In today’s ultra-competitive and dangerously litigious business climate, you can’t afford to throw the dice with your most valuable asset. Your exposure is far greater than you may think, personally and professionally. As a sole proprietor, you have unlimited liability if your company is sued, regardless of size. You could lose all of your assets.

Most accountants and CPAs advise clients that they can only incorporate once they reach a certain profit level – say, $ 30K- $ 50K. Why? Most CPAs realize 50% of businesses don’t make it past year one, and the others lose money that will show up on Schedule C. They understand their clients want to avoid filing and paying for a separate tax return. Could a lawsuit be devastating? Of course, it is likely the first year, perhaps not, but continuing this path can lead to financial paralysis.

Their Financial Future…

Here are just a few things you would struggle with or be completely unable to do if your business is sued:

• You may not be able to get a loan for a new home, refinance or take a second mortgage on your current home. (We’ll explain why in a moment.) At best, you’d have to pay a much higher interest rate because you’re now considered a higher risk to the lending institution – through no fault of your own.

• You may not be able to finance a new car.

• You may not be able to lease office space.

Why do lawsuits cause such a problem with loans? If you have yet to recently apply for a home loan, a second, or financing for a car, you may not be aware of how times have changed. Five years ago, financial forms asked, “Do you have any judgments against you?” That meant, “Have you been sued, lost the suit, and had a judgment levied against you?”

However, financial institutions have gotten smarter. They’ve tightened up the system they use to rate levels of risk for loan applicants. Today’s loan applications ask a very different question: “Are you currently involved in a lawsuit?” That means that if anyone tries to sue you for any reason, frivolous or not, at the very least, you’ll be rated as a much higher risk. (Remember, that’s before the

suit is even decided.) And that translates to a lot of money out of your pocket! Result: You may be financially paralyzed!

Are you willing to forego that dream home, that new car, because someone tripped on a pavement crack in your business’s parking lot? And imagine what being unable to lease office space could do to your business.

Creating a legal entity separates the business from you so that any legal action can only affect that entity – not you personally!

This is by far the biggest reason to incorporate or form an LLC. It makes no sense to have a sole proprietorship unless you have no assets or future assets; in this case, you shouldn’t – and wouldn’t – be in business.

Sole Proprietors Are Risking Their Credit And Capability For Future Financing!

You may think, “I don’t plan to have a sole proprietorship. I’m convinced that I need to form an entity.” Could you let me know when you’ll take action? If you wait 30 days or longer, do you realize the negative impact on your business? Although a lawsuit can pop up quickly, a MUCH more significant (and disturbingly common) mistake lurks at this vital business start-up phase.

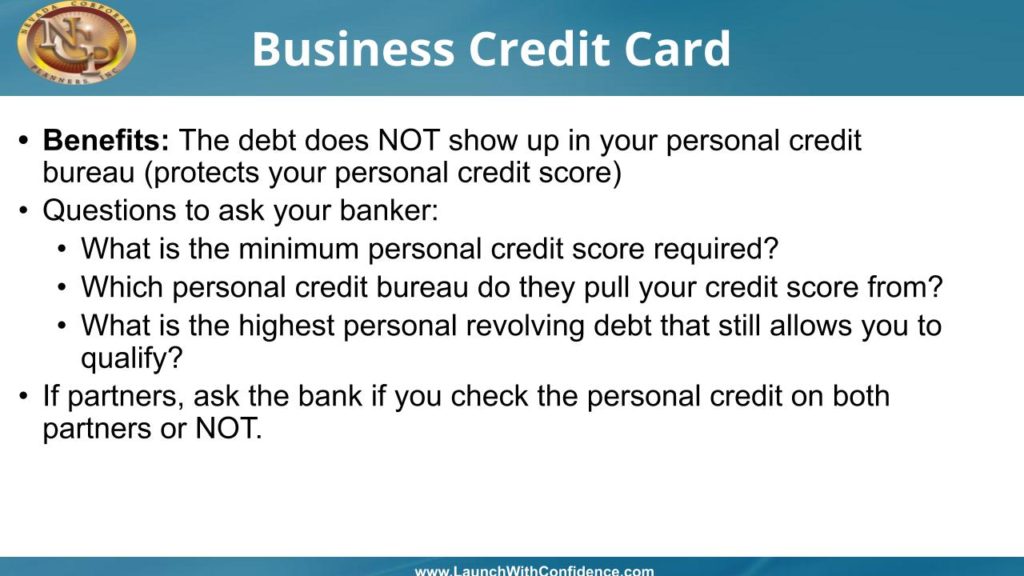

Using your credit cards to finance the start-up of your business is the most widespread mistake. Added to the folly of operating as a sole proprietorship with a “Let’s see how we do first before we incorporate” mentality, it’s a recipe for disaster. Here’s why:

Financing your business with your credit (credit cards, home equity line of credit, etc.) negatively affects your “revolving debt ratio.” That ratio is a significant factor in your new corporation or LLC’s ability to obtain a business credit card at the start… and, later, a business line of credit.

Why is this so important? The #1 reason business owners fail, especially during the first six months, is the need for cash flow. That’s when the folly of overestimating revenue and underestimating expenses rears its ugly head. And for most small business owners, that behavior is as predictable as the sun.

NCP is one of the few, if not the only company, that literally “Cracked the Bank’s Code” on your business lines of credit. We spent more than four months going back and forth with a major bank to figure out exactly how they decide who does not get those valuable lines of credit, who does, and how much they get.

Factors such as the “liquid credit score,” the risk category of your business, gross revenues, personal credit score, derogatories, and revolving debt are all considered.

Here’s the bottom line: If you’re starting your business by nearly or entirely maxing out your credit cards, the bank will ignore you. Even with a 700 personal credit score, if your revolving debt is close to 90% maxed out, that sends the bank an obvious message that you cannot manage your debt. Why give you money to start a business? You’re on your own financially.

Don’t be misled by TV or Internet ads about “business credit,” either. Usually, they refer to “trade lines of credit,” which don’t give you actual cash to use as you choose in your business. If you’re building homes or have over 30 employees, developing trade credit can be important — but it still needs to be cash. You can’t use trade credit to make payroll spend on pay-per-click advertising or any other strategies you need to start doing quickly to gain that all-important competitive edge.

Want a simple solution?

• STOP using YOUR CREDIT CARDS ASAP!

• Open a BUSINESS CREDIT CARD and use that ONLY for your business expenses.

Yes, it is personally guaranteed, but it will NOT negatively impact your revolving debt ratio.

That’s critical advice as your business gets started. Remember, when your corporation or LLC applies for a business line of credit, half of the bank’s formula in determining eligibility is your credit score — and, most importantly, the revolving debt ratio.

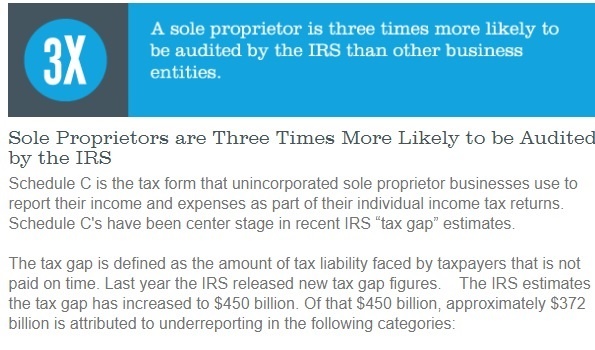

Sole Proprietorships Are 300% More Likely To Be Audited By The IRS. Even By Las Vegas Standards, Those Are Incredible Odds!

Fact: The IRS is currently targeting sole proprietorships. Why? In a self-audit last year, the IRS discovered a $300-billion tax gap — meaning that more than $300 billion of taxes go unpaid annually. They concluded that the biggest offenders were not large corporations but small business owners who owed around 70% of that $300 billion. Of that group, 1/3 were sole proprietorships. You can bet the IRS isn’t going to ignore that low-hanging fruit! You are 300% more likely to be audited if you file a Schedule C.

Is Your Business a Hobby or a Business?

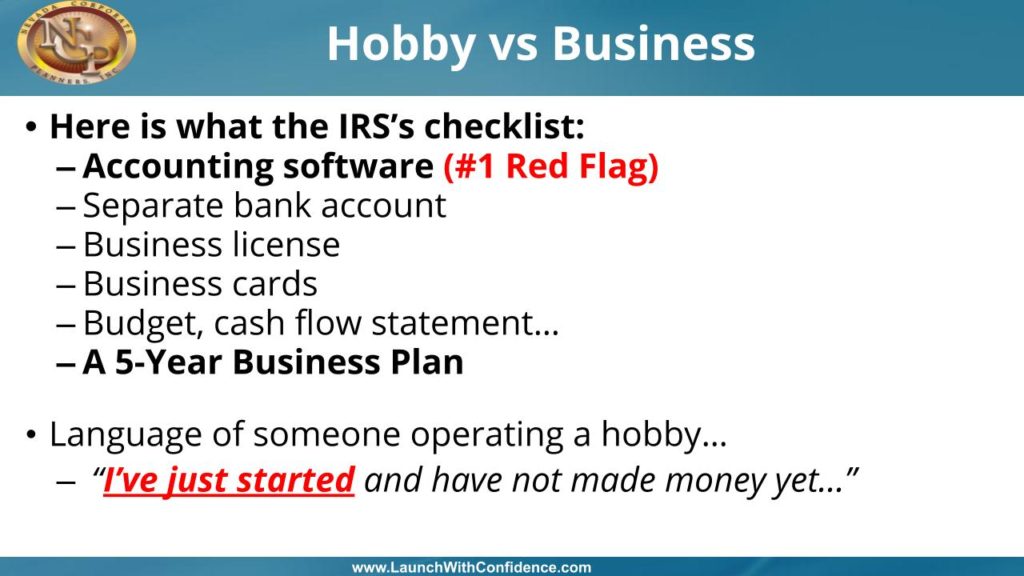

Most people enjoy a hobby — golf, tennis, cooking — and while they’ll spend money on those activities, they’re not a business. Yet when most people join a business opportunity or start a business, though they don’t consider it a hobby, that’s often what they create because they don’t know the game’s rules.

But they have a problem: The IRS is getting tougher on this subject. The #1 reason the IRS goes after business owners is the failure to use proper analytical records. You’d be well advised to use software like QuickBooks® to determine how your business is operating — to update your gross revenue, cost of goods sold, and income.

New business owners make the biggest mistake of using their online bank balance as their only business financial barometer. First, that’s the wrong way to make financial decisions. Second, it sends the IRS an obvious message: you must be more serious about your business. This single mistake may cause the IRS to consider your business a hobby. If they do, you cannot write off your hobby’s losses against your earned income — and that kills one of the biggest reasons to start a business in the first place.

67% Of All U.S. Businesses Operate As Sole Proprietorships. If Your Clients Are Business Owners, How Do You Protect Yourself?

If everything we’ve told you is correct (and it is), how do you keep your own business safe? To understand the mindset, consider these three simple yet costly myths:

• Myth #1: Sole proprietorships are simple — the most comfortable business structure to operate. As you know by now, the worst choice is to operate as a sole proprietorship. Unfortunately, simplicity and asset protection are “inversely related,” meaning the more protection you have, your situation may become more complex. I know that does not resonate with many of you. But your goal is to accumulate profit and assets; the more assets you collect, the more you must protect them.

The good news is that you need not go it alone. The key is strategizing with a knowledgeable, experienced advisor to develop your optimal protection plan. After all, it would be best to stay focused on adding value and profit to your new venture, not become an expert on business start-up methods. It would be best if you only had to do that once — but do it right.

• Myth #2: Most start-up business owners cover only one component of the big picture by getting tax advice from their professionals. But there’s more. Could you benefit by having a separate legal entity to help save on taxes? Which entity is best for your venture? As you know now, there are many elements to consider.

• Myth #3: I’m a good person and have insurance. Why would anyone sue me? That’s admirable, but that’s not how the game is played. Desperate people don’t care if you’re a “good person.” If you have money — or the perception of money — you’re a potential target!

Don’t bury your head in the sand. Now that you’re aware of the pitfalls take action yourself and arm your clients with the tools and information to be successful. After all, ensuring your clients prosper is in your best interest! How do you make that happen? Call NCP and ask for more information on how we can help your clients and your business!

We touched briefly on the question of insurance just now. Let’s go a little deeper.

Insurance Is Not A Fool-Proof Safety Net

Even though many professionals tell you you’re protected by insurance, you can still spend a lot of money defending a lawsuit without ever having a claim against your insurance policy.

But what if a claim is made? Insurance may provide some level of protection – but the worst case is that protection may be only as good as the legal representation you can afford. (I need to find out how many clients had found that their insurance companies weren’t nearly as friendly when they filed a claim as when they first signed up!).

True, you can get Errors and Omissions insurance (or “E&O”), business liability, and even officers’ and directors’ insurance — and again, a good policy should provide some protection. But NONE of those will help you protect the corporate veil (a hugely important benefit that we’ll discuss later.)

NO insurance policy in existence can do that.

If you have a minor insurance claim of $10,000, your insurance company will usually pay it. However, if you claim $900,000, put the coffee on because you can expect a visit from your insurance company’s attorneys. Why? You can find a loophole in your policy so they don’t have to cover you. And, of course, even if they cover you, your rates will skyrocket – if your policy isn’t canceled!

Don’t Expect Sympathy from the Courts, Either.

Are you a landlord now, or do you have plans to own real estate in the future? If you’re ever sued, remember that juries are made up mostly of tenants, jealous tenants who don’t own a house – yet you have several. This is their chance to get even with every landlord who hit them with a late-rent charge or made them get rid of that pet. It’s pay-back time! Is it fair? No – but it’s human nature.

And consider this: Most judges earn less than you do. How sympathetic could they possibly be? Unless you know NCP’s asset protection strategies, you should hand over your checkbook and the title to one of your houses.

The bottom line? Win or lose, even with insurance, you could become financially paralyzed by being a sole proprietor.

Does it make sense to leave yourself exposed? Of course not, especially when the solution is simple, sophisticated, and reserved for the AT&T of the world. The answer is to incorporate it! Creating a legal entity separates you from your business so that any legal action will not affect you personally.

Here’s an added benefit of incorporation: As any good marketer will tell you, perception is everything in the marketplace. That “LLC” or “Inc.” after your name helps people perceive you as more significant than you may be. Plus, it adds to your credibility – as well as it should. It shows that you’re aware of the pitfalls lurking, you’ve done your homework, and you’ve taken the appropriate steps to protect yourself and your company. You’ll be around next year and the year after that. And that message to the marketplace translates to a direct effect on your bottom line.

Be Sure To Play By the Rules

It’s essential to do things properly when you incorporate them. Remember, when your company incorporates, you create a separate legal entity. Your corporation must be treated as such. If the corporation is sued and there aren’t enough assets or insurance, the plaintiff may decide to go through the corporation and after you. This is called “piercing the corporate veil,” and the consequences can be devastating. (Please take a look at that later. You are essentially a sole proprietorship again, financially paralyzed, with a lawsuit against you!

How do you keep this from happening? Your new corporate entity MUST:

• Follow corporate formalities, keeping recorded minutes and resolutions;

• Have proper capitalization, which is the amount of money you put into the

corporation to get it started;

• MUST NOT co-mingle funds with your account. Under no circumstances

can you use corporate funds to pay for your expenses?

We’ll take a closer look at how these three requirements can be breached or compromised.

• Lack of corporate formalities. Here’s an example: When a corporate officer goes on a business trip, the corporation must have a meeting to authorize that trip. This is hard for some to understand, especially if you’re a one-person corporation and wear all the hats. You must still show that the trip was approved in your corporate meeting minutes because the corporation is NOT YOU. It must be treated as a separate legal entity.

Some people will tell you that an LLC can perform different formalities than an S- or C-Corporation. (CPAs sometimes recommend an LLC mainly because of a lack of formalities.) While this is somewhat true, it is changing.

We’ve discovered recent court cases involving piercing the LLC veil, where the judge looked at corporate cases for guidance, particularly concerning formalities. Accordingly, the use of the term “piercing the corporate veil” has evolved to “piercing the entity veil” or “piercing the LLC veil.”

NCP maintains corporate formalities for LLCs, as well as for corporations. Our LLC record books have more than 50 pages of resolutions to protect our LLC clients. (We’re one of the few companies in the U.S. to do so for our LLC clients.)

• Lack of proper capitalization: It has to be capitalized when you form a corporation. That usually means money is put into a corporate checking account. The corporation’s stock is issued to whoever capitalized it (usually an individual, but it could be another entity). Specific guidelines in each state ask, “Did you capitalize the corporation with enough money/assets, or was it too thinly capitalized?”

But what exactly is “too thinly capitalized?”

Lately, an unfortunate trend has been appearing in the courts. They’ve adopted a sort of “20/20 hindsight” in some situations, and companies in high-liability sectors like manufacturing are especially at risk.

For example, you’re a widget maker with five employees. You’re capitalized at $50,000 and have a $1-million insurance policy – which is appropriate because widgets are cheap, and you sell only a few. Then one day, Joe Employee cuts off a hand with the box cutter and saddles you with a $3-million lawsuit. The court says, “Mr. Business Owner, when you formed this company, you should have known that Joe would slice off a hand someday, and you should have known that your insurance would cover only $1 million of the $3 million he’d want. Since you only have $50,000 in capitalization, we’ll consider your company too thinly capitalized. Therefore, we’ll allow piercing your corporate veil to recover the rest.”

Crazy? Of course. But true.

You can capitalize on a corporation or LLC with cash, assets, and, in most states, services. However, services can create a tax problem. For example, say your partner owns 50% of the corporation and capitalizes it with $25,000. You own the other half and capitalize it with services (called “sweat equity”). The IRS says you received an asset without paying anything; therefore, they treat that $25,000 worth of services as personal income to you. That means you have to claim $25,000 in personal income. But I don’t remember you earning money. You did get stock in a company, and now you have to pay taxes on it!

One solution might be for your partner to loan $24,000 and then have both partners capitalize the entity with $1,000 each.

Remember, the corporation has to repay the $24,000 as a loan, whereas it was a capital investment in the first case, which does not have to be paid back. This is a potential problem with partners when it is unclear whether the money is capitalization or a loan.

• Co-mingling of funds. As a sole proprietor, you no doubt have a company bank account. You can use that money for your business or personal expenses. Your CPA will help you determine which part of that money was deductible for business expenses and which portion was for personal expenses at the end of the year.

Your CPA often finds that you spent a lot of money on personal items that are not deductible business expenses. Still, the only consequence to you is that your net profit is higher than you thought, so you owe more in taxes than you expected.

It’s very different in a corporation. There must be a separate checking account used for business purposes only. Using that money for personal reasons is called “co-mingling of funds,” The consequences are dire. A judge may set aside the corporate veil because you ignored that the corporation is a separate legal entity from yourself – leaving you exposed.

Summary: Incorporating your company helps separate your identity from your business. Sole proprietors and partners are subject to unlimited personal liability for business debt or lawsuits against their company. Creditors of the sole proprietorship or partnership can bring suit against the business owners and seize the owners’ homes, cars, savings, or other personal assets. Once incorporated, the corporation’s shareholders have only the money they put into the company to lose, usually no more.