Strategy Zoom Call

Get clarity on which state, which entity, your U.S. tax strategy, steps to update or create a new Amazon account, banking, Shopify Payments, and other key components to save you time and money on your U.S. expansion. Strategy calls are with our CEO, Main Street Certified Tax Advisor, and e-commerce expert, Scott Letourneau.

State Filing Fees

State filing fees vary based upon the state and type of entity. A Wyoming LLC is $100, and a Nevada LLC is $425.

Mail Scanning and Forwarding

Our U.S. virtual address service provides a lease agreement and U.S. utility bill option. We understand the importance of your U.S. business address for account verification, banking, Shopify payments, and U.S. taxation concerns.

In regards to any critical mail you may receive, from your 6-digit Amazon code to your EIN number to trademark filings, our team is the best to scan, rename, and alert you. We are the only mail service providers that are experts on action steps and the best resources on how to handle your tax and IRS notices.

U.S. Bank Account (if required)

You may be working with Payoneer, a free account, and if you need a separate, fully functioning U.S. bank account to set up Stripe or Shopify Payments, we can help. Some “online banks-technology companies” such as Mercury, require a U.S. tax person, which is NOT a single-member LLC disregarded. Too many are committing fraud on the W-9.

Resale/Exemption Certificate

A resale certificate proves that you are a legitimate retailer or purchaser and are buying products to resell or use as parts of products you plan to resell.

To use a resale certificate, in many states, you need to register to collect sales tax in at least one U.S. state. Our team will register your new company in a state and obtain your resales/exemption certificate.

Dun & Bradstreet Number

The D-U-N-S Number is used to establish your company’s D&B® file. It is requested but not required to sell on Walmart.

A Second EIN (if required)

If you form an LLC and the member (owner) will be your foreign entity, we will need to apply for an EIN for the foreign entity.

This is required to file the U.S. return in connection with the tax treaty with your country. Most common is the 1120F, along with form 8833.

If this is your situation, the SS4 application for the U.S. entity will require your signature as the responsible party. The IRS no longer allows you to use your foreign entity EIN to apply for the U.S. EIN. That changed in 2020.

We can move forward and apply via fax for the EIN on your U.S. LLC. The EIN for your foreign entity we call over the phone (when we get through to the IRS).

Trade Name/DBA

If you are using or planning to use a trade name separately from your new entity name, we will file a DBA (doing business as) in the state of formation.

Amazon Brand Registry Example:

When you set up your Amazon account, you will have your brand name and sold-by name. Your seller name is easy to change on your Amazon account.

The brand name leads to the brand store page and is linked to registered and trademarked brands. The brand name does not match your entity name.

Nationwide Trademark Search & Filing

A trademark is a protected word, phrase, symbol, or design that identifies your business and distinguishes it from other businesses. This is important for Amazon’s brand registry and overall brand protection. It is not required but recommended.

Local Utility Service & Bill

If you don’t update your Amazon Seller Central account correctly with your new details, it may trigger a notice to provide more verification. The critical item is an accepted utility bill or business license matching your Amazon account’s company and address.

We can provide this service for Nevada entities only with our address service for our clients.

This service is optional when the correct steps are followed with our Amazon checklist. Our clients that follow our steps EXACTLY do NOT need an extra utility bill (which may cost more than the entity formation).

Please take a look at our utility bill example below. It will be in your company name.

ITIN

An ITIN will come into play if a 1040NR U.S. tax return is required by filing form W-7, along with 8833. In this situation, the fee is part of filing your U.S. personal tax returns.

If you need an ITIN after your U.S. entity formation, the most common is to provide you with more options with your U.S. formation when you open a Stripe account or Paypal account.

If you are forming an LLC taxed as a corporation (creating a U.S. taxpayer), obtaining an ITIN up front is not going to happen, but we have a work around approved by our tax team for our clients.

Certificate of Insurance (COI)

If you received your 30-day notice from Amazon, our process is to form your LLC correctly and refer you to our recommended U.S. insurance provider.

Our services include the steps to change and not to change on Amazon to get your COI approved by Amazon.

We have a 100% success rate when you follow our steps.

Corporate Coaching

Receive unlimited strategy support from our team via e-mail on your most pressing topic, including U.S. taxation, capitalization, ownership issues, e-commerce verification, funding, and much more.

Tax Packages

Receive support for filing your U.S. tax returns and working with our recommended CPA firm, as well as tax updates.

Amazon Account Verification Services

We are partnered with professionals who can escalate your Amazon account verification through the right channels through our partners. Our U.S. LLC packages include our comprehensive Amazon New Account Guide to help you avoid verification issues.

Strategy Call

You can schedule a paid strategy call with our CEO, Scott Letourneau. The time frame is 2-4 business days. You will receive your action plan, steps, prices, and strategy options within 24 hours of your scheduled call.

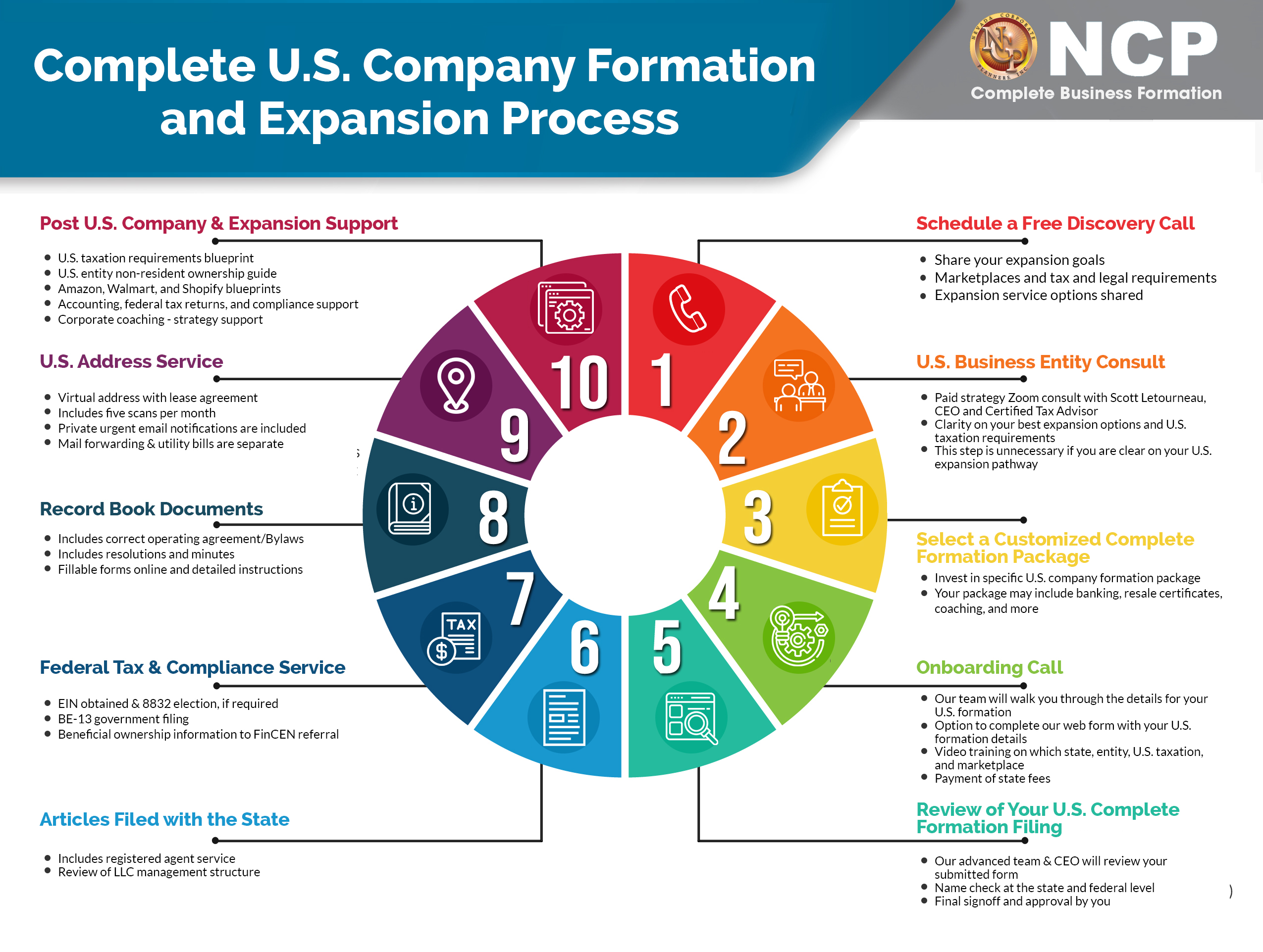

U.S. Entity Formation Process

After you pay, you will receive our web form with our U.S. entity training video.

Once you submit your web form with all your entity details, our team will review it and send you a final confirmation email to reply to before we file your new U.S. entity.

Our team will prepare the articles and SS4, and our CEO will review them before filing. Once the articles are filed, you will also have the SS4 form to sign so we may fax it to the IRS.

Your EIN letter will come within 3-4 weeks after your articles are filed and your EIN is faxed to the IRS. This will impact your banking, perhaps U.S. insurance, setting up your Amazon account, and other key strategies.

On your strategy call with Scott, he will review the time frame that fits your situation.

Payment

You will be sent a customized payment link the same day and you may pay by credit card, PayPal, or wire transfer.

The Completion of our U.S. Entity Form

You will receive this immediately after payment, and it can be completed in less than 10 minutes. Video instructions are included. If you have questions, send us a support ticket; our team is very responsive. Our team and CEO will review all formations before being filed to ensure everything lines up to match your U.S. e-commerce goals.

U.S. Entity Web Form Review and Approval

This process will be completed within 24 hours during business days, with either a question for clarification for your reply or a final approval email for verification requiring your reply. We never file what you submit online. We aim to ensure it aligns with your strategy call with Scott.*

Articles Filed to the State

Time varies upon the state chosen, and Nevada and Wyoming (which are most popular) are filed within 24 online.

EIN Service

There are two factors, we email the SS4 to complete and email back to our team, you will receive it the same day of the filing, and once you return it, we will fax it the same day to the IRS.

The IRS time frame is about 9-12 business days. The EIN confirmation letter, CP 575, is mailed to our address within about two to three weeks after the EIN is obtained.

[Update] Our new banking partner does not require the IRS letter upfront; the EIN can be pending.

Record Book Documents

You will have all your documents, including your operating agreement, membership certificates, minutes and resolutions, stock ledger statement, and instructions in the cloud within 48 hours of filing your articles.

U.S. Banking

You may already have a relationship with an online payment platform service and may update a new account with them directly. If you need a U.S. bank account to establish a U.S. stripe account or for an ACH to pay sales tax (Shopify sellers), we can help you through that process.

The banks will need the EIN letter that is mailed from the IRS, as well as other business and personal documents.

Post U.S. Company Formation Support

This is ongoing as needed to make the transitions on your marketplaces and updates.

Additional Services

- Trademark Filing: Varies based upon whether the entity’s name will be trademarked or a separate brand name.

- Amazon Certificate of Insurance: This process will take 3-4 business days after completing your insurance application online. This includes receiving a quote and making a payment.

- Stripe Account: A Stripe account first requires an ITIN, a separate service, and may take 6-8 weeks to obtain from the IRS.

- Resale Certificate: After entity formation, this may take 3-5 business days after you submit our sales tax application.

- Sales Tax Registrations: This applies to Shopify, and if you are selling on your website, over time, you will cross economic nexus thresholds in each state. Our complete sales tax registration process is based upon completing our sales tax application payment of any state fees, which states we need to mail with no SSN, whether or not they mail the PINs, codes, or permits so that we may complete your tax accounts.

- Accounting Set-Up: Depends upon the time frame you are ready to implement.

- U.S. Tax Returns: Due dates for the following year and support options will be provided.

- Strategic Consulting: If you need support with additional strategy questions, from how much to capitalize on your new entity to tax questions, our strategic consulting with unlimited strategy support emails will be ideal for you.

Time Frame Summary

After your discovery call, your entity formation may be, on average, 2-3 business days, and your EIN is currently 9-12 business days. For a certificate of insurance, the EIN is not typically required upfront, which helps protect your Amazon account faster.