A sole proprietorship is the simplest form of business. It’s not a separate entity. Instead, as a sole proprietor, you own the business and are directly responsible for its debts. Remember that whenever you do something the “simplest” way, it’s typical for your results to be directly proportional to the effort required. It is the most common approach, but not necessarily the best. What makes a sole proprietorship a popular choice?

Let’s Address the Components of a Sole Proprietorship? These are the reasons this is a popular choice for first-time entrepreneurs.

Management and Control: As the business owner and sole proprietor, you retain complete management and control over your company. However, the price you pay for total management and control is near the total risk for personal liability incurred through your agents’ or employees’ acts.

No Formalities: Except for complying with applicable licensing requirements, you’ll find no formalities required of a sole proprietorship. However, when you conduct business under a name that does not show your name or implies additional owners’ existence, your state may require that you file a fictitious business name statement and publish notice. If your name is Joe Smith and your business is called “Joe Smith’s Services,” you won’t have to file. If you name your business “Joe’s Services,” “Smith’s Services,” or “Smith and Sons,” chances are good that you will have to file. And, if you want to deduct your expenses, you’ll still have to log them into a diary format on a timely and consistent basis-no matter which entity form you choose.

Transferability: As the owner of a sole proprietorship, you can sell your business at will.

Duration: The sole proprietorship remains in existence for as long as you are willing or able to stay in business.

Why be a Sole Proprietor when there are Better Options?

Compare the advantages (and disadvantages) of sole proprietorships to other corporate structures, and you’ll realize that S corporations offer owners more protection against liabilities generated by their businesses. Specifically, S corps can take advantage of pass-through taxation, meaning there are generally no corporate-level federal income taxes to worry about. Instead, all the company’s income, deductions, and tax credit items are “passed through” to the shareholders, which they then report on their Form 1040 and pay the taxes.

In contrast, running your business as a C corporation can result in double taxation, meaning your business income gets taxed once at the corporate level and again when liquidated or when dividends are distributed. Keep in mind this is a simplistic answer. There are also many advantages to a C corporation, and the effects of double taxation can be minimized, as you will soon see.

S corporations have strict qualification rules:

- Only citizens or residents of the US can be shareholders.

- The corporation can only have one class of stock.

- The corporation may only have individuals, estates, or certain trusts as shareholders. Partnerships and corporations cannot be shareholders.

- There must not be more than 100 shareholders.

Looking to form an LLC?

Remember, the LLC can be taxed in four different ways. Plus, you MUST have the correct operating agreement to match the number of members.

It would be best if you also considered these major disadvantages to an S corporation:

- The stock of an S corporation is tough to protect from a personal lawsuit. In contrast, a C corporation’s stock can be held by a family limited partnership or an LLC taxed as a partnership.

- S corporations are taxed in some states and must file a state-level tax return.

- If the S corporation owns appreciated assets, they cannot be distributed to you without triggering an income tax bill. There is no such problem with a sole proprietorship.

Let’s look at the tax benefits of an S corporation over the sole proprietorship.

As the shareholder-employee of a solely owned S corporation, you receive a salary, subject to a 15.3 percent federal payroll tax (for Social Security and Medicare) on the first $147,000 and 2.9 percent on the excess (for 2022). As your employer, the corporation pays half, and the other half gets withheld from your paychecks. The corporation deducts your salary as a business expense on its tax return (Form the 1120S).

Under current law, pass-through income is not subject to SE (Self-Employment) tax. In contrast, all income from a sole proprietorship is subject to SE tax. An LLC taxed as a partnership (if the member is deemed actively involved) is most likely subject to SE taxes.

Strategy: Pay yourself a reasonable salary to avoid federal payroll taxes. Just make sure it’s not too low. Have industry comparisons on hand to show you’re in the ballpark.

Example: The taxable income generated by your S corporation business is $147,000 for 2022 before you pay yourself. You take a $40,000 salary. That amount is then hit with the 15.3 percent federal social security tax and Medicare tax, which amounts to $6,120. You can withdraw the remaining corporate cash flow in the form of distributions to yourself, which will not be subject to SE taxes (this will be added to your personal income. You will pay tax at your current tax bracket).

If you operate the same business as a sole proprietorship, all the profits are subject to SE taxes. You would owe SE tax on your entire $100,000 profit, for a total of $15,300 (15.3 percent up to $142,800). Operating as an S corporation could save you thousands ($15,300-$6,120= $9,180).

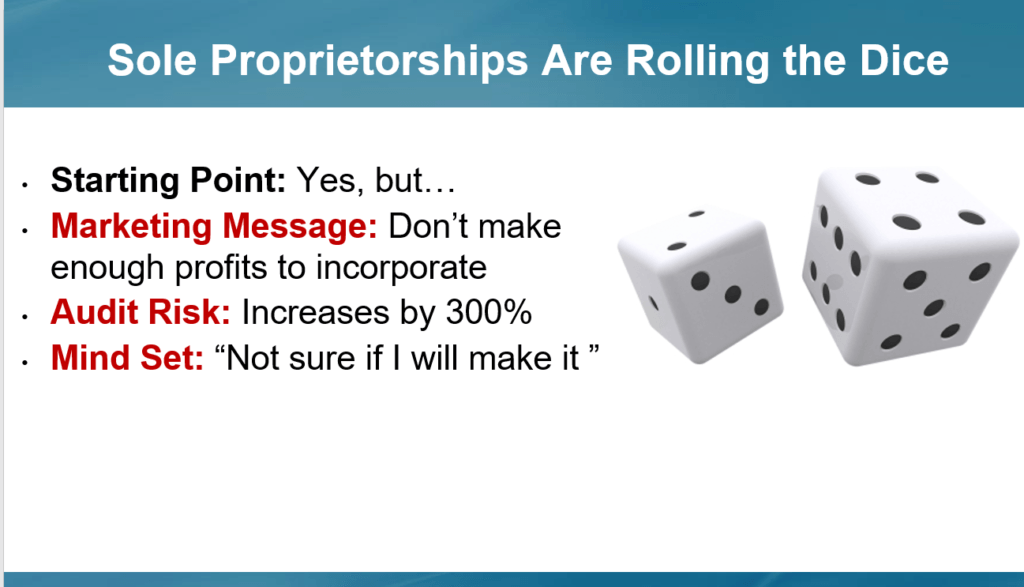

Besides, a sole proprietorship that files a schedule C is 300% more likely to be audited. Last year, the IRS did their own audit and determined they were $300-billion short in taxes. Thirty percent of that shortfall was from small business owners, of which 1/3 were schedule C filers. In 2022, the newly supercharged IRS with 87,000 NEW AGENTS will lead to another 1.2 million audits each year. Learn more here. The IRS is on track to receive an additional $45 BILLION in additional funding in 2022. See the IRS’s complete funding proposal. Even if the new legislation does not pass, the writing is on the wall, so take steps to get off schedule C ASAP for 2022.

Remember: You must be able to show that a $40,000 salary is reasonable. If the IRS thinks it’s too low, it may try to reclassify all or part of your purported cash distributions as disguised wages.